Custom Insurance Software Development Services

Intellectsoft is a paramount global provider of software solutions for the insurance industry. We help the world’s insurance organizations to boost their efficiency, profitability, and safety through innovative digital transformation technologies.

INSURANCE SOFTWARE DEVELOPMENT SERVICES

Get custom insurance software and rely on our digitalization services and expertise to boost your organizational efficiency, reduce costs, and ensure a top-quality experience for your end user.

Our custom fintech solutions are built to offer a superior user experience while keeping your customer's data secure.

Intellectsoft insurance software development services offer the best-in-class quoting solutions to exceed end-users' and partners' needs and deliver high-quality results.

By automating crucial processes and workflow, your insurance industry experts will increase their efficiency, speed, and security of claims processing.

Build an efficient value chain for your partners, vendors, and customers with our expertise in providing insurance industry software solutions.

Add value to your business by using our insurance software development services and expertise in creating chatbots and mobile apps to the fullest.

The promise of Big Data and analytics in the insurance industry brings hope for quick adaptation to modern information super-abundance.

Take full advantage of Intellectsoft's custom insurance software development capabilities to reach out to your clients across multiple channels and build strong relationships.

Optimize your insurance and reporting processes by getting a new financial custom solution from scratch or upgrading the one you have.

CUSTOM INSURANCE SOFTWARE DEVELOPMENT AND CONSULTING

Scale your delivery capacity with intelligent cooperation models.

TECHNOLOGY EXPERTISE OF THE INSURANCE SOFTWARE DEVELOPMENT COMPANY

Leading insurance carriers benefit from our professional services and methodologies that accelerate growth and impact the bottom line.

-

Legacy System

TransformationLegacy System TransformationModernize your legacy systems to keep pace with changing technologies and business environments. Let our experts enhance your crucial software by integrating advanced web or mobile solutions, upgrading your infrastructure, and bringing only necessary innovations.

-

Customer

ExperienceCustomer ExperienceTransforming the Customer Experience is a new and powerful shift for the Insurance domain that can bring about quantum change. Implementation of customer experience requires transforming traditional strategies, workflows, processes, and technologies.

-

Internet of

ThingsInternet of ThingsThe insurance business is predicated on data, and IoT provides volumes of data. IoT technology changes the way insurers assess, price, and limit risks, with a wide range of potential advantages and best insurance software solutions for the company.

-

Big

DataBig DataOur experts can bring you efficient insurance software solutions using a variety of Big Data development tools to help your organization achieve even the most ambitious goals.

-

Blockchain

BlockchainMore than 80% of insurance companies claimed they adopted or were planning to adopt blockchain technology. The need for innovation in insurance is critical — customers are craving transparency, speed, and cost flexibility.

-

Artificial

IntelligenceArtificial IntelligenceOur deep domain expertise enables insurers to become AI-driven and powered by automated machine learning. Artificial Intelligence in Insurance is already being used in many ways, from intelligent Chatbots that offer fast customer service round the clock to the array of machine learning technologies that improve insurance industry software solutions.

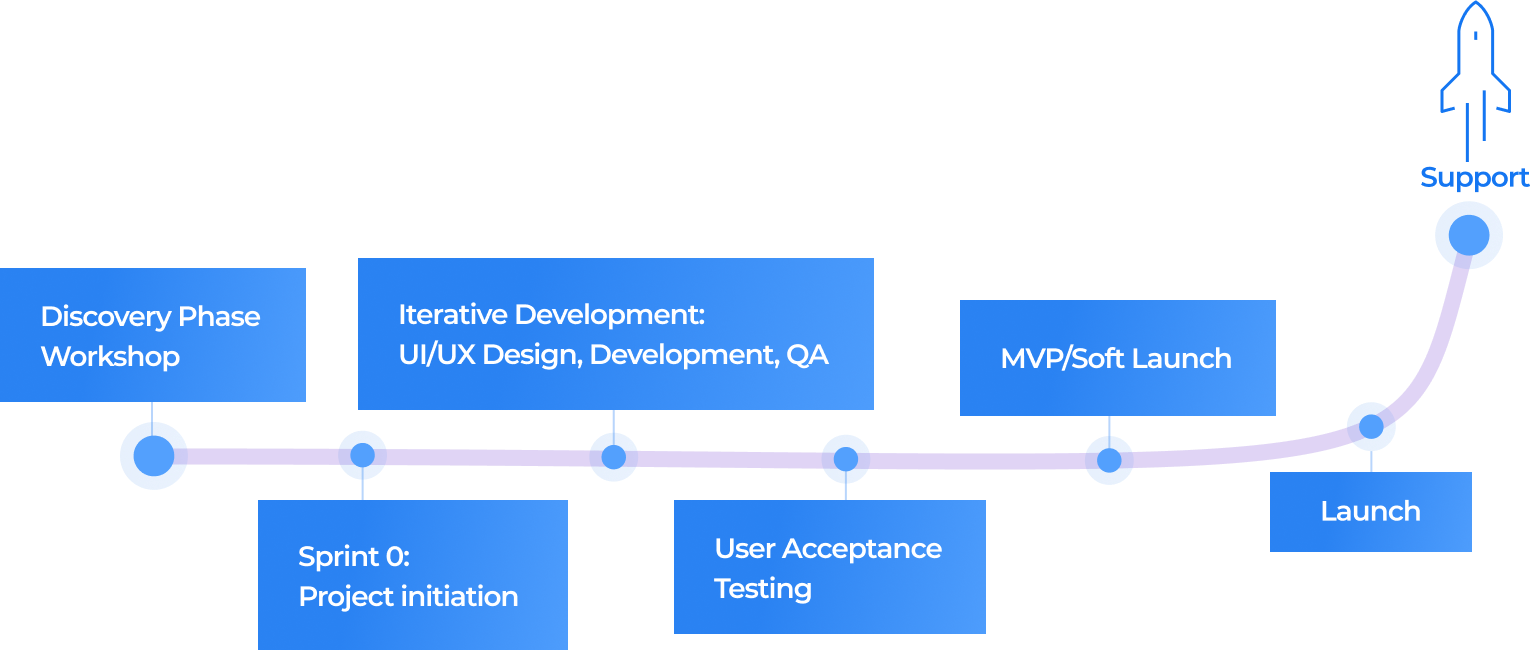

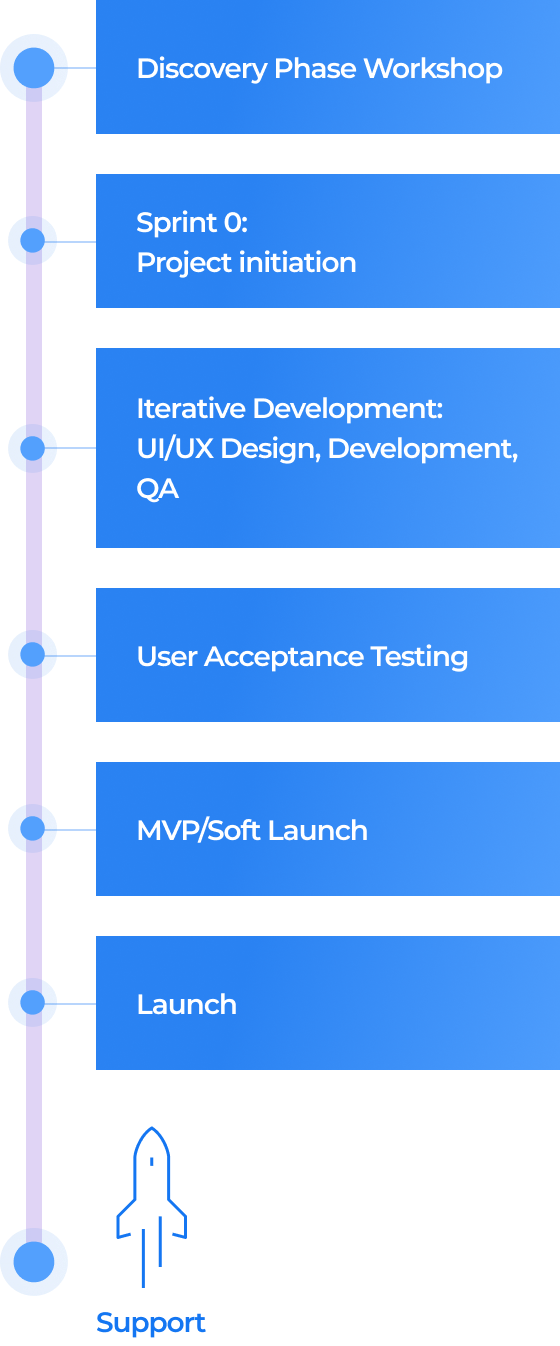

PROJECT DEVELOPMENT PROCESS FOR INSURANCE SOFTWARE SOLUTIONS

We provide full-cycle IT support, operational transformation, and high impact insurance software solutions that help insurance companies deliver personalized, efficient, and informed care.

- A shared understanding of project objectives

- Business requirements transformed into functional

- The initial vision of the architecture of the project

- A project plan that includes risks and budgets

- A clear product strategy and development roadmap

Download our CASE STUDY

Custom Cloud-Based Solution Helps Leading Insurance Provider Improves Customer Experience

Do you have additional questions?

What Is Insurtech Consulting?

Insuretch consulting is specialized in helping insurtech startups and mature technology solution providers to enter and expand market activities and technological possibilities in the best possible way.

How Is Maintenance of Legacy Insurance Systems Implemented?

Legacy insurance systems maintenance needs a systematic approach that includes regular updating, bug fixing, and security checkouts to ensure that every part of your legacy functions flawlessly. Depending on your legacy system’s size and complexity, its maintenance may require a team of tech engineers who will minimize the possibility of issue occurrence and extend your legacy system lifespan.

What Is Custom Insurance Underwriting Software?

Custom insurance underwriting software ensures quality insurance software solutions for improved internal process efficiency and reduced turn-around time.

What Is Custom Insurance Policy Management Software?

Custom insurance policy management software breaks down into two key processes:

• creating policies

• maintaining policies

Where to Hire Specialists for Custom Insurance Claim Management Software Development?

If you are looking for custom insurance claim management system developers then, you are in the right place. Intellectsoft is specialized in providing software development team services. Get quick, specific tech, and domain expertise acquisition.

What Are Six Steps to Consider Before Starting Insurance Mobile App Development?

There are six steps to take before creating an insurance mobile app of any complexity:

1) Do market research and analysis

2) Define your target audience

3) Determine whether it should be native, hybrid, or web application

4) Choose your monetization options

5) Create a marketing strategy, promotion plan, and plan for app store optimization

6) Take proper security measures

What Does Insurance API Development and Integration Mean?

Insurance API development and integration is the connection between applications, via their APIs, that lets those systems exchange data. Throughout many high-performing businesses, API integrations power processes keep data in sync, enhance productivity, and drive revenue.

What Does Insurance Quoting Software Development Stand for?

Insurance quoting is the amount of money that an insurance company calculates as the cost of providing insurance for something. One of the primary purposes of the insurance quoting software development process is eliminating paperwork and face-to-face contact.

What Does Insurance Compliance Software Development Mean?

It means the process of building a software solution with a set of functionalities and features that would solve the needs of the insurance company and adhere to all necessary regulatory requirements and industry standards.

What Is Insurance Risk Management Software Development?

Risk management software's primary purpose is to identify potential risks before they occur to plan risk handling activities, thus mitigating the adverse impact on achieving project objectives.

How Is Insurance Document Management Software Implemented?

Insurance Document Management Software empowers clients to streamline documents generated and received by organizing them in a single repository. This kind of software helps insurance companies to organize, manage, manipulate, and store data easily, resulting in better service for their customers and end-users.

What Do Insurance Agency Software Solutions Include?

Here is a list of possible insurance agency software solutions:

• Product & service reinvention

• Underwriting & claims automation

• Risk & document management solutions

• Modernized platforms & digital ecosystems

• Compliance & quoting software solutions

Thank you for your response!

We have sent an email to to acknowledge receipt of your request. In the event that you have not received our email, we kindly suggest checking your spam folder or alternatively, contacting us directly at info@intellectsoft.net

Send againWhat’s Next?

- We will send a short email notifying you that we successfully received your request and started working on it.

- Our solution advisor analyzes your requirements and will reach back to you within 3 business days.

- We may sign an optional mutual NDA within 1-2 business days to make sure you get the highest confidentiality level.

- Our business development manager presents you an initial project estimation, ballpark figures, or our project recommendations within approximately 3-5 days.